- GLC Research's Newsletter

- Posts

- syrupUSDC integrates with AAVE ?

syrupUSDC integrates with AAVE ?

syrupUSDC could soon join AAVE. This report explores the potential impact, technical challenges, and what an AAVE listing could unlock for Maple.

Welcome to the GLC Research Newsletter.

We’re a buyside crypto research firm focused on delivering clear, independent insights. We also collaborate with a few select projects to help improve transparency and reporting for stakeholders.

In this edition, we’re covering Maple’s Potential Integration with AAVE. This report explores the potential impact, technical challenges, and what an AAVE listing could unlock for Maple.

Thanks again for subscribing. We’re glad to have you with us.

Let’s get into it.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Disclosure: Authors own $SYRUP and syrupUSDC.

Key Takeways

A proposal to onboard syrupUSDC as collateral on AAVE has been submitted, potentially unlocking new lending, looping, and composability strategies.

Past listings on AAVE have significantly boosted the adoption of assets like sUSDe, USDS, and Pendle PTs. A dynamic known as the “AAVE Effect.”

syrupUSDC has already been integrated into Pendle, Morpho, Euler, and Kamino, with strong traction and incentives across Ethereum and Solana.

If listed, syrupUSDC would gain access to AAVE’s deep liquidity and user base, accelerating adoption and yield generation.

Listing is contingent on technical adjustments, which the Maple team has committed to addressing in collaboration with AAVE risk teams.

Introduction

As a partner of Maple, we’ve been closely tracking syrupUSDC’s progress over the past several months, and it’s safe to say the dollar yield asset has had an exceptional first half of 2025, with no signs of slowing down.

Year to date, syrupUSDC stands out as one of the best-performing yield-bearing stablecoins (YBS) in the market. Its assets under management (AUM) have surged, growing from $118M to $2.2B, while its total supply increased from $58M to $940M, making SyrupUSDC the third-largest YBS, behind Ethena’s sUSDe and Spark’s sUSDS.

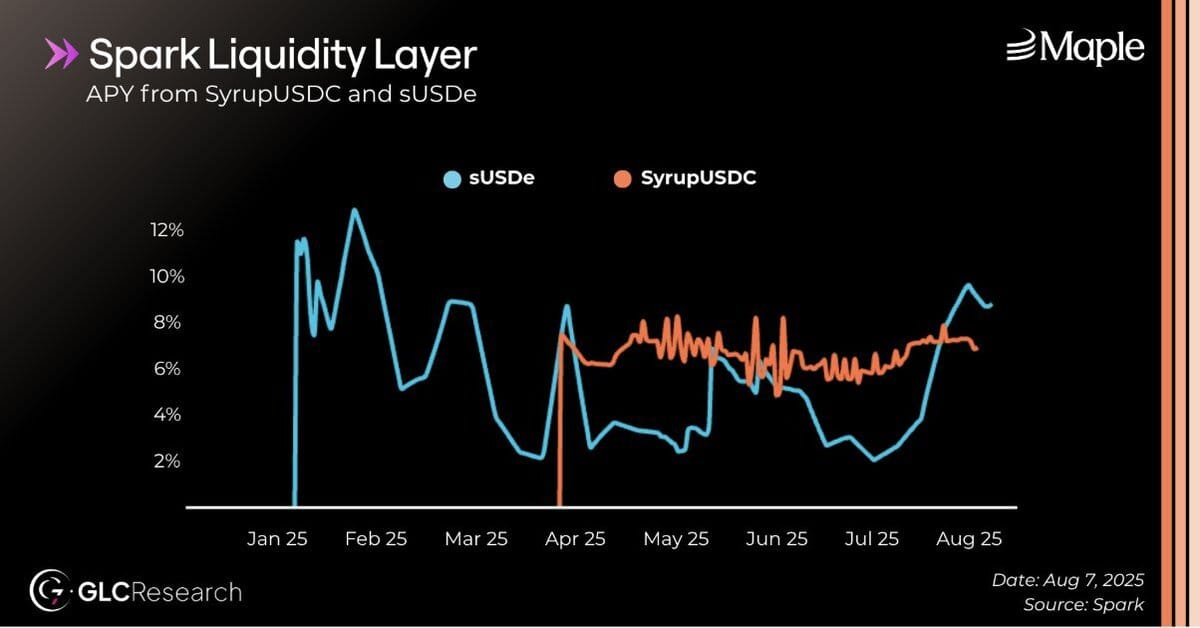

On the yield side, syrupUSDC has outperformed its peers for two consecutive quarters. Looking specifically at Q2, an equal-dollar investment at the beginning of the quarter would have returned 1.6%, ahead of Aave’s 0.85% (a common benchmark) and Ethena’s 1.29%.

A key driver of this impressive growth has been SyrupUSDC’s integration into leading DeFi protocols, including Pendle, Morpho, and Euler on Ethereum, as well as Kamino and Drift on Solana.

Now, syrupUSDC might be on the verge of joining AAVE, the largest DeFi money market, a protocol that has played a pivotal role in the growth of many of today’s most prominent DeFi assets.

This is what’s known as the AAVE Effect, and we’re about to witness how it could shape the next phase of SyrupUSDC’s evolution.

AAVE [ARFC] Proposal: SyrupUSDC Onboarding Overview

Following a successful [Temp Check], an [ARFC] proposal was initiated on June 27 to onboard SyrupUSDC as a collateral asset on AAVE V3.

There are several key motivations for AAVE to move forward with this integration:

Exposure to a new source of yield, driven by institutional borrowing activity through Maple.

Increased USDC utilization and lending rates, fueled by strong anticipated borrower demand.

A projected boost in AAVE’s TVL as a result of this new asset.

$250K in incentives from Maple to support the launch and initial adoption.

If this collaboration proves successful, the ARFC already outlines the potential future onboarding of additional Maple-originated assets, including a yield-bearing BTC asset.

Given the associated risks, the proposal suggests an initial supply cap of $50M for SyrupUSDC.

The AAVE Effect: Why Listings Matter

With this upcoming integration, Maple is poised to benefit from what is widely known as the AAVE Effect.

SyrupUSDC is a highly compelling asset, but in DeFi, product quality alone does not guarantee adoption. Distribution is the key. Maple has clearly recognized this and has strategically pursued integrations across major DeFi protocols this year, including Pendle, Morpho, Kamino, and others.

Still, in today’s ecosystem, and until proven otherwise, the ultimate milestone for any asset remains a listing on AAVE.

The reason is simple. After years of consistent growth and leadership, AAVE has become the benchmark for DeFi money markets. It is the largest DeFi protocol ever built, currently representing more than 25% of total DeFi TVL. The network effects it has created are unparalleled, and its liquidity is unmatched. Asset listings follow a thorough and transparent risk assessment process, making inclusion a strong signal of quality and resilience.

Once listed, an asset joins the inner circle of DeFi’s most trusted and efficient instruments, gaining access to a level of demand that cannot be replicated elsewhere.

The AAVE Effect has already had a transformative impact on assets like USDe and sUSDe from Ethena, USDS from Sky, and rsETH from Kelp DAO.

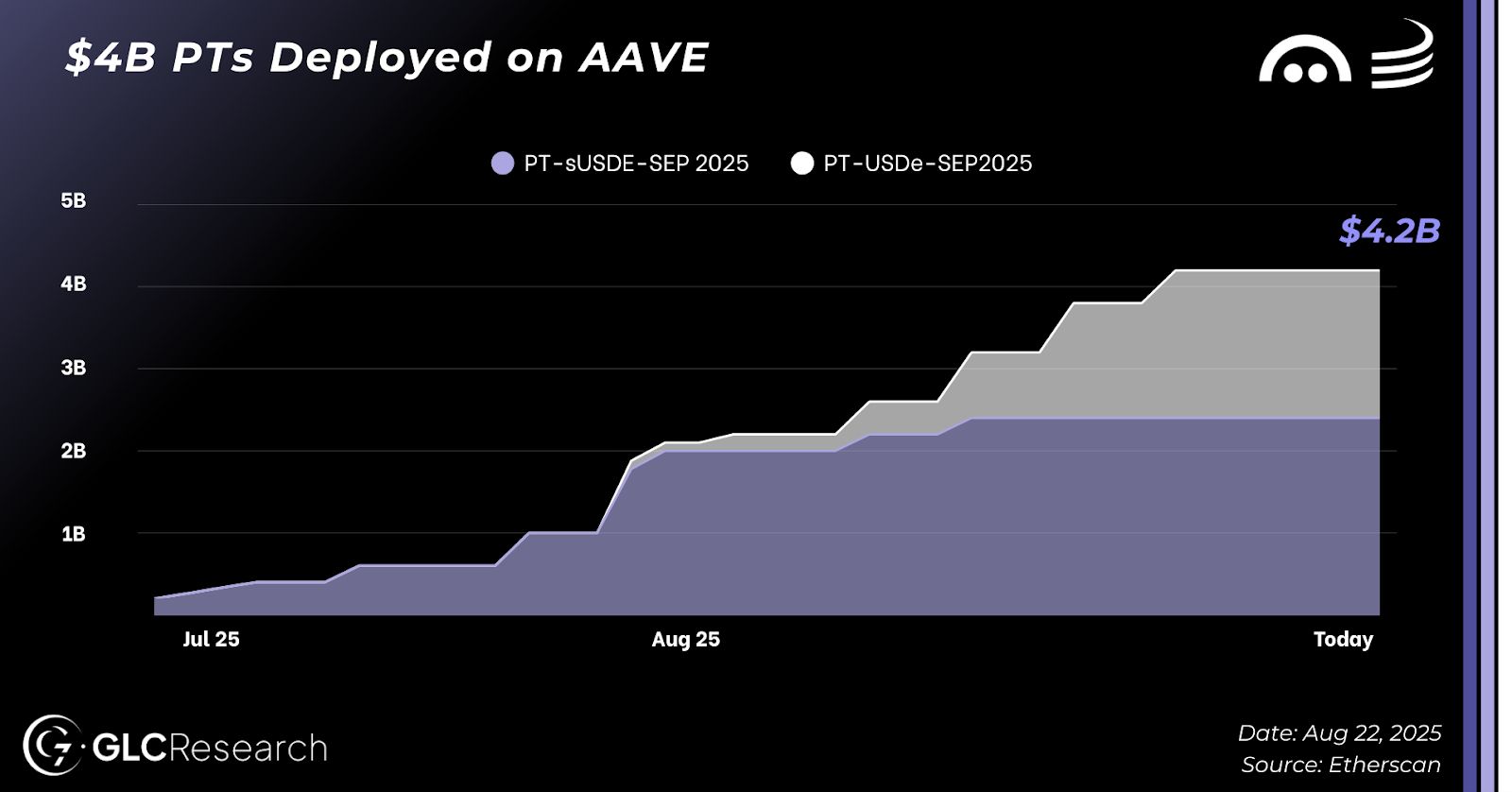

Another recent example is the rapid rise of Pendle’s Principal Tokens (PTs) on AAVE. Since May 2025, users have been able to supply Pendle PTs as collateral on AAVE, unlocking the ability to borrow against them and enabling a new level of composability in DeFi.

In just three months, over 4 billion dollars of Pendle PTs, based on Ethena assets have been deposited on AAVE.

With this momentum in mind, PT-SyrupUSDC may very well be next in line.

SyrupUSDC’s Flywheel Potential

As highlighted by Martin de Rijke during our Q2 report, Maple’s primary objective remains the broad distribution of SyrupUSDC to support its adoption across the ecosystem. This includes integrations with CeFi programs, wallets, and decentralized money markets.

The integrations executed over the past months have played a significant role in SyrupUSDC’s expansion. At the time of writing, approximately 10% of the total supply is deployed on Pendle, ≃5% on Morpho, and ≃5%on Kamino.

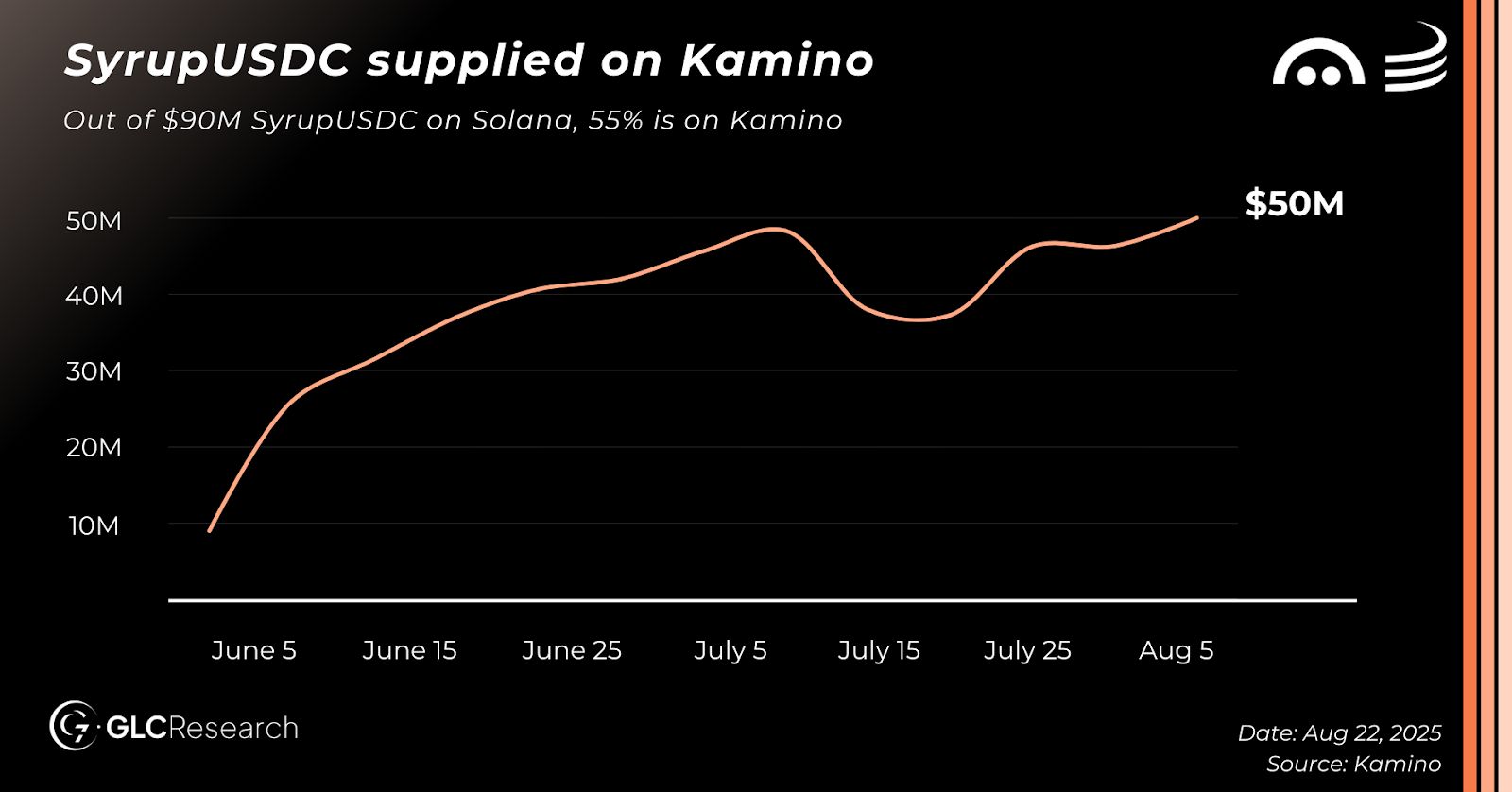

The integration of SyrupUSDC on Kamino, Solana’s flagship lending and borrowing protocol, went live on June fifth. It now stands as a relevant case study to gauge the potential impact of an AAVE listing.

In just two months, more than fifty million dollars worth of SyrupUSDC has been deployed on Kamino. This represents 54% of the total SyrupUSDC supply on Solana. The growth was fueled by over $500K in incentives.

How long will it take to reach $50 million, $100 million, $1 billion SyrupUSDC on AAVE ?

If integration happens, we believe it’ll be very fast.

How Pendle and AAVE Drive Stablecoin Adoption

We won’t go into all the details here, but AAVE and Pendle have been the strongest user acquisition engines for yield-bearing stablecoins lately, both key drivers of Ethena’s success. See our Pendle investment thesis to learn more and the AAVE effect article.

For syrupUSDC, the missing piece is AAVE: integrating it would unlock more capital-efficient looping strategies between PT syrupUSDC and AAVE, widely seen as DeFi’s most secure protocol.

Performance-wise, syrupUSDC outpaced sUSDe in Q1 & Q2 and has shown greater stability thanks to a more stable yield source. Still, its yield depends on loan growth, and an AAVE integration would make it much more attractive.

Meanwhile, if Maple continues to scale outstanding loans, the upside is massive. As Marc put it: “I know we can push it to multi-billions”, though not without risks.

What Needs to Be Done Before Listing?

Marc also highlighted that some adjustments are needed before AAVE can list syrupUSDC. As BGD noted in the ARFC: “We believe syrupUSDC does not face any infrastructural barriers to listing; however, we identify technical blockers that directly affect the security of users’ funds on the Aave Protocol.”

They also mentioned ongoing discussions with the Maple team to address these issues so AAVE can be comfortable listing syrupUSDC. More details here.

Maple responded: “First of all, we thank BGD for their thorough analysis and are pleased to note their overall positive feedback on the Maple protocol. At Maple, we operate to the highest institutional, technical, and security standards. We welcome constructive feedback, and we are proactively taking BGD’s recommendations onboard. The Maple team is already working to address these points and implement the solutions.”

It’s encouraging to see both teams working together to ensure alignment with AAVE’s risk framework. While there’s no set timeline, we believe Maple is committed to making the necessary adjustments to secure a listing on AAVE, which could become another strong growth catalyst.

Final Thoughts

If SyrupUSDC is listed on AAVE, it could be a major inflection point. AAVE listings serve as both a stamp of credibility and a distribution engine, unlocking liquidity and demand at a scale no other protocol matches.

For Maple, this would elevate SyrupUSDC from a fast-growing YBS into a core DeFi money market asset. For users, it would enable new capital-efficient strategies, like looping PT SyrupUSDC against AAVE collateral, further reinforcing adoption and yield dynamics.

Technical adjustments still need to be made before listing, but Maple has committed to addressing them in collaboration with AAVE.

If successful, SyrupUSDC could follow the same growth path we’ve seen with sUSDe and Pendle PTs, accelerating into the top tier of DeFi yield-bearing assets. AAVE doesn’t just list assets, it elevates them and SyrupUSDC might eventually get its moment.

Hope you enjoyed reading this report.

If you found it valuable, feel free to share it with others and follow us on X. You can also join our free Telegram group, we’re always up for thoughtful discussions and idea-sharing with the community.

Stay tuned, more in-depth insights are coming your way soon.