- GLC Research's Newsletter

- Posts

- Q3 Performance Report: syrupUSDC(T)

Q3 Performance Report: syrupUSDC(T)

syrupUSDC outperforming the competition ?

Welcome to the GLC Research Newsletter.

We’re a buyside crypto research firm focused on delivering clear, independent insights. We also collaborate with a few select projects to help improve transparency and reporting for stakeholders.

This report examines syrupUSDC(T) performance during Q3 2025, analyzing its growth, yield evolution, and adoption across major DeFi protocols. It also compares syrupUSDC(T) to other yield-bearing assets, assessing its stability, competitiveness, and strategic role within Maple’s broader ecosystem.

Thanks again for subscribing. We’re glad to have you with us.

Let’s get into it.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: Analysts behind this report own $SYRUP & syrupUSDC. In addition, GLC is working with Maple as independent research partner.

Key Takeaways

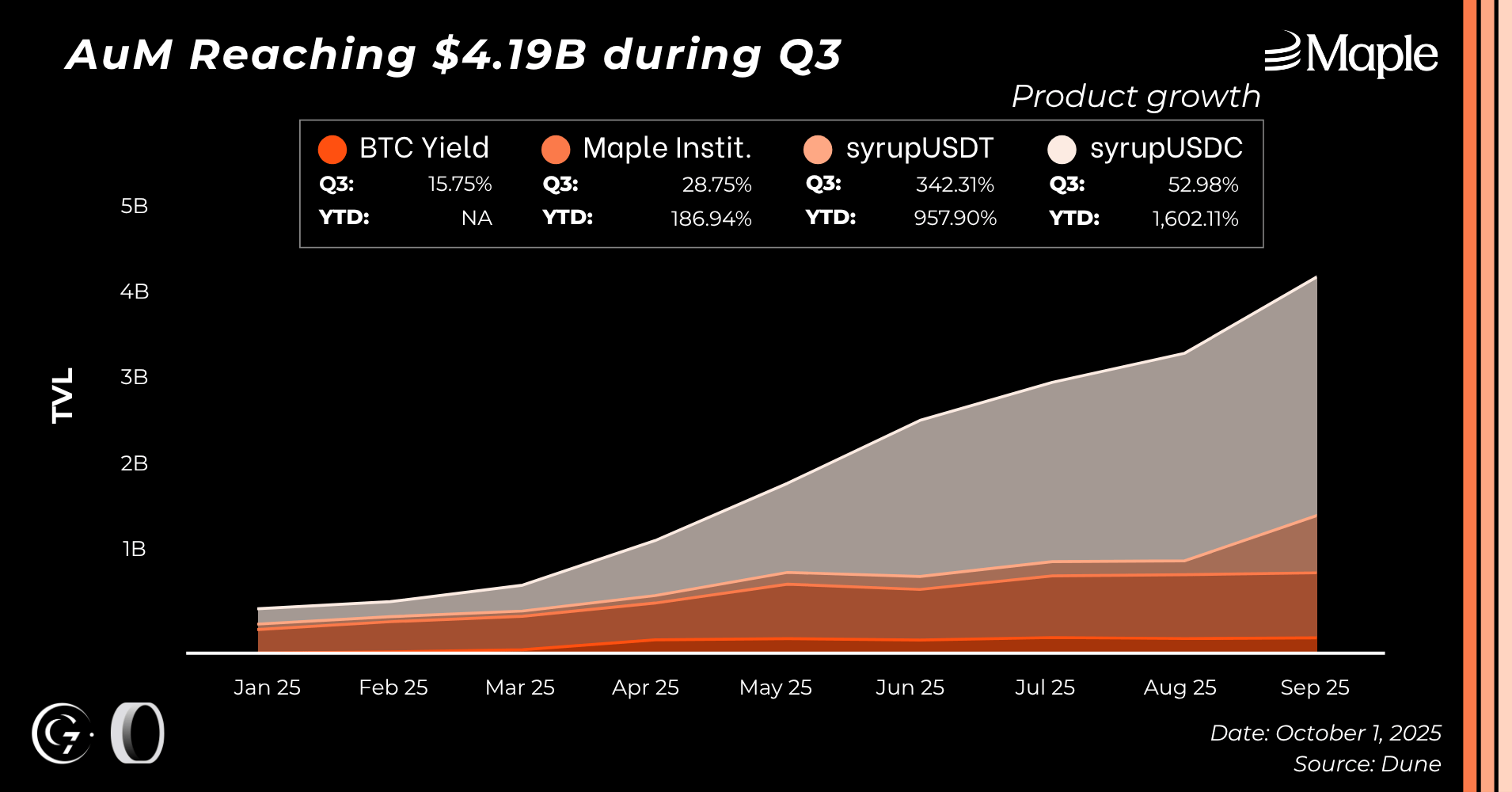

Record Growth: syrupUSDC grew from $155 million in AUM in January to over $2.5 billion in Q3. It is now the third-largest yield-bearing dollar in DeFi.

Broader Ecosystem Reach: syrupUSDC is live on Ethereum, Solana, and Arbitrum. Solana showed strong momentum after the launch of Jupiter Lend.

Consistent Yield: syrupUSDC delivered a 1.6% return in Q3 and about 6% year-to-date. It outperformed Aave and matched Ethena’s sUSDe with lower volatility (0.24% vs. 1.81%).

Rising Confidence: The narrowing yield premium versus Aave’s USDC rate shows increasing trust in Maple’s credit model and risk management.

Product Expansion: syrupUSDT was the fastest-growing product in Q3, rising 342% to 636 million dollars after its relaunch on Plasma.

Context About syrupUSDC(T)

Launched in 2021, Maple has established itself as a leading onchain asset manager, providing secure and transparent yield solutions for both institutional and individual participants.

In Q2 2025, the protocol underwent a major positioning update, unifying all its offerings under the Maple identity to better reflect its evolving strategic direction and market positioning. Today, Maple operates through two primary distribution channels:

Institutional Access: Designed for accredited entities, this channel requires KYC verification and a structured onboarding process, including legal and due diligence procedures. Flagship products in this segment include Blue Chip Secured Lending, High Yield Secured Lending, and BTC Yield.

Individual Access: Open to all users, this permissionless channel offers access to institutional-grade yields through syrupUSDC(T).

This report focuses on syrupUSDC(T), Maple’s flagship yield-bearing dollar, with the objective of assessing its Q3 performance, benchmarking it against comparable assets, and analyzing the strategies and risk framework that underpin its success.

syrupUSDC(T) represents a liquid, yield-bearing dollar available in both USDC and USDT denominations. It enables depositors to earn consistent, high returns through exposure to Maple’s institutional credit markets. The yield is derived from interest payments made by creditworthy institutional borrowers who access capital through the Maple protocol. These borrowers secure their loans with digital assets (+80% Bitcoin collateral), while lenders, syrupUSDC(T) holders, earn the resulting interest income.

Maple’s lending framework is structured around short-duration, overcollateralized loans (currently with a 140% collateral ratio), enabling dynamic rate adjustments and stable yield delivery. All underwriting is conducted by the Maple team, which performs credit assessments and ongoing monitoring of institutional borrowers to ensure strong collateral standards and robust risk management practices.

This structural discipline allows syrupUSDC(T) to deliver competitive, risk-adjusted returns while maintaining liquidity and transparency. Since its inception, syrupUSDC(T) has consistently outperformed most comparable products in terms of real USDC yield, a performance that has fueled its recent growth and adoption within DeFi.

GLC Perspective on syrupUSDC(T)

At GLC, we have been very vocal throughout 2025 about our conviction in syrupUSDC(T). In today’s DeFi landscape, launching a new protocol or a yield-bearing asset has become remarkably easy. New products appear almost daily, each with flashier tickers and double-digit yields that would make our TradFi counterparts raise an eyebrow.

Many DeFi participants spend their time rotating capital toward the highest-yielding opportunities. However, it is essential to remember that higher yield always comes with higher risk, and pricing that risk accurately remains one of DeFi’s greatest challenges.

Recent months have seen several yield markets collapse, with multiple yield-bearing assets losing their peg and resulting in significant capital losses for depositors.

In contrast, Maple’s syrupUSDC(T) stands out as one of the most consistent and transparent yield products in DeFi, delivering a stable 6–7% annualized return. Its yield comes from interest payments made by institutional borrowers, not from temporary incentive programs that can disappear overnight. The product is managed by one of the most competent teams in the industry, with a proven track record of resilience through multiple major market downturns, demonstrating the strength of its risk management framework.

Furthermore, users looking to enhance their yield have extensive opportunities to do so. syrupUSDC(T) is deployed across three chains and integrated into dozens of DeFi protocols, allowing capital to be looped or redeployed efficiently without taking on excessive risk.

In our view, syrupUSDC(T) is one of the best-performing and most reliable yield-bearing dollars in the market. The continuous growth of its AUM throughout the year supports this conviction, as we will explore later in this report.

syrupUSDC Yield Performance

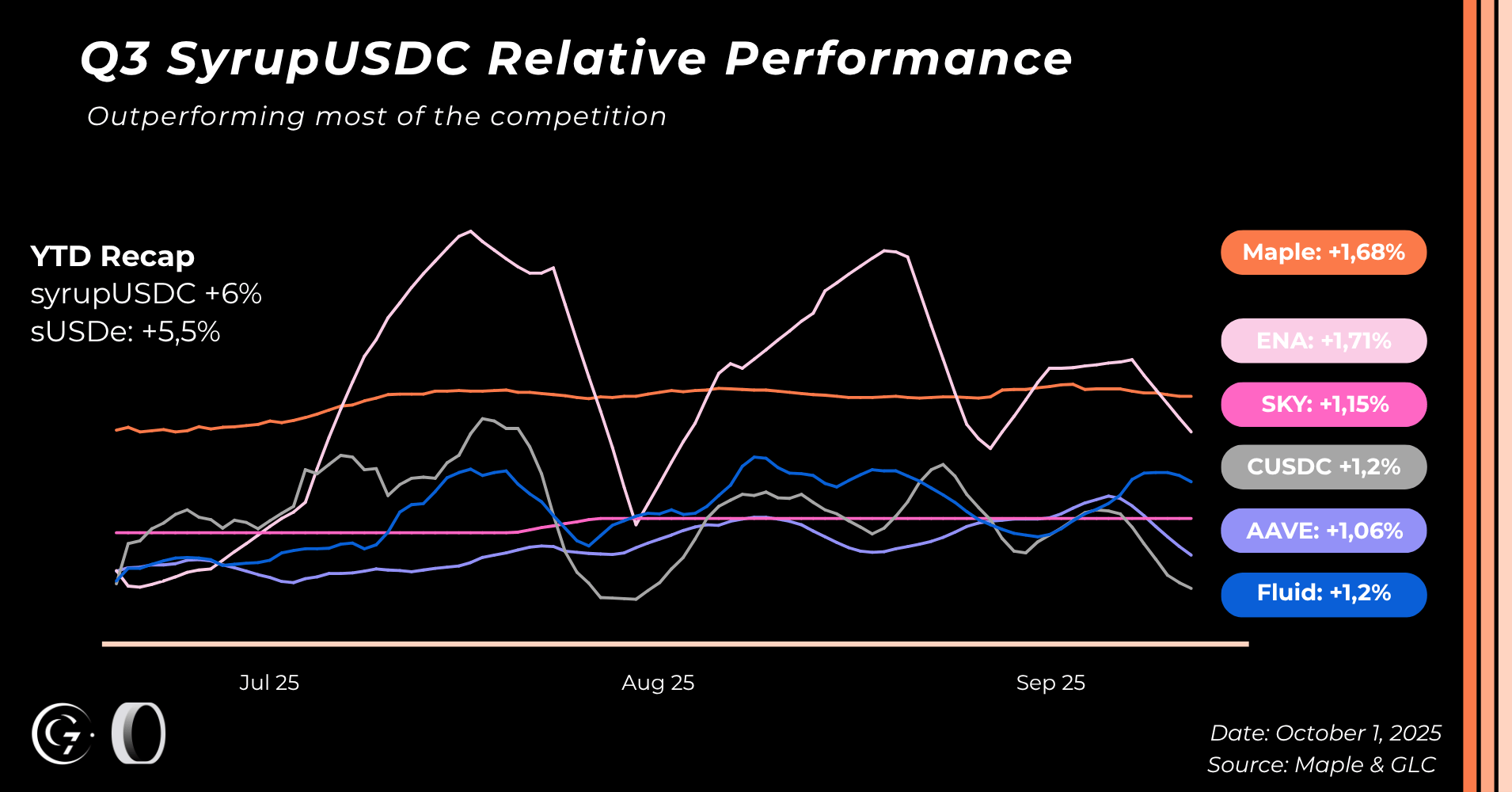

Maple’s core product, syrupUSDC, once again delivered strong performance in Q3. When comparing the returns of investing an equal dollar amount at the beginning of the quarter, syrupUSDC outperformed its peers, delivering a 1.6% return over the period. For comparison, Aave’s USDC yield, often used as a benchmark, returned around 1%.

Ethena’s sUSDe was on par with syrupUSDC’s performance, and both outpaced the broader market average.

Yield Stability and Risk-Adjusted Performance

This quarter marked another period of strong and stable returns for syrupUSDC, which continues to position itself as one of the most reliable and efficient yield-bearing dollars in DeFi.

Yields improved across the board, with syrupUSDC returns increasing from 1.63% in Q2 to 1.68% in Q3. More notably, syrupUSDC has now outperformed Ethena’s sUSDe year-to-date although sUSDe remains one of the best-performing yield-bearing stablecoins.

Volatility for syrupUSDC was only 0.24% this quarter, compared to 1.81% for sUSDe, highlighting its smooth and predictable return profile. This blend of high yield, low volatility, and broad adoption continues to strengthen syrupUSDC’s position as one of the most trusted yield assets in DeFi.

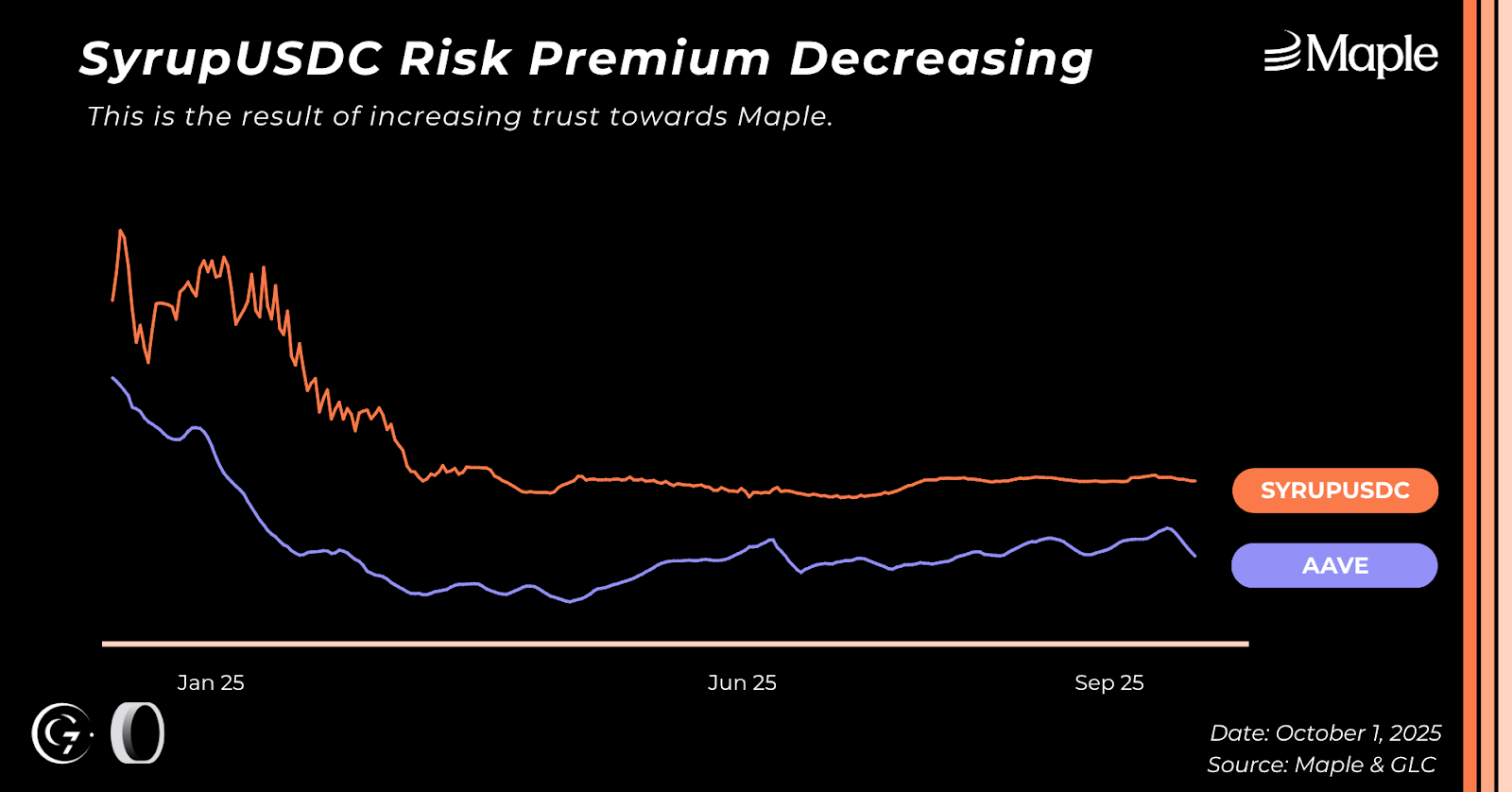

One of the most notable developments this quarter is the continued decline in syrupUSDC’s yield premium relative to Aave’s USDC yield, often regarded as DeFi’s risk-free rate. The narrowing spread indicates that investors increasingly view syrupUSDC as a lower-risk yield instrument, demonstrating rising confidence in Maple’s credit infrastructure.

Another factor contributing to this trend is syrupUSDC’s growing integration into DeFi money markets, allowing users to incorporate it into broader strategies and adjust their risk profiles to seek higher returns.

This aligns with the observation made in the Q2 report during the discussion with Martin, Head of Growth at Maple, which predicted a continued compression of the yield premium.

TVL Evolution in DeFi Protocols (Q3)

Since the beginning of 2025, Maple’s strategic focus has centered on scaling syrupUSDC, which has grown from 155 million dollars in AUM in January to over 2.5 billion dollars as of this report. This milestone positions syrupUSDC as the third-largest yield-bearing stablecoin in the market, behind only sUSDe (Ethena) and sUSDS (Spark).

This growth has been driven by deep integrations across major DeFi protocols such as Morpho, Pendle, and Euler, as well as by Maple’s multi-chain expansion. syrupUSDC is now available on Ethereum, Solana (since Q2), and Arbitrum (since Q3). This cross-chain deployment enhances accessibility to institutional-grade yield and enables users to efficiently capture opportunities across ecosystems.

As of Q3, syrupUSDC’s total supply stands at 1.297 billion dollars, distributed across chains as follows: 78.32% on Ethereum, 15.67% on Solana, and 6.01% on Arbitrum.

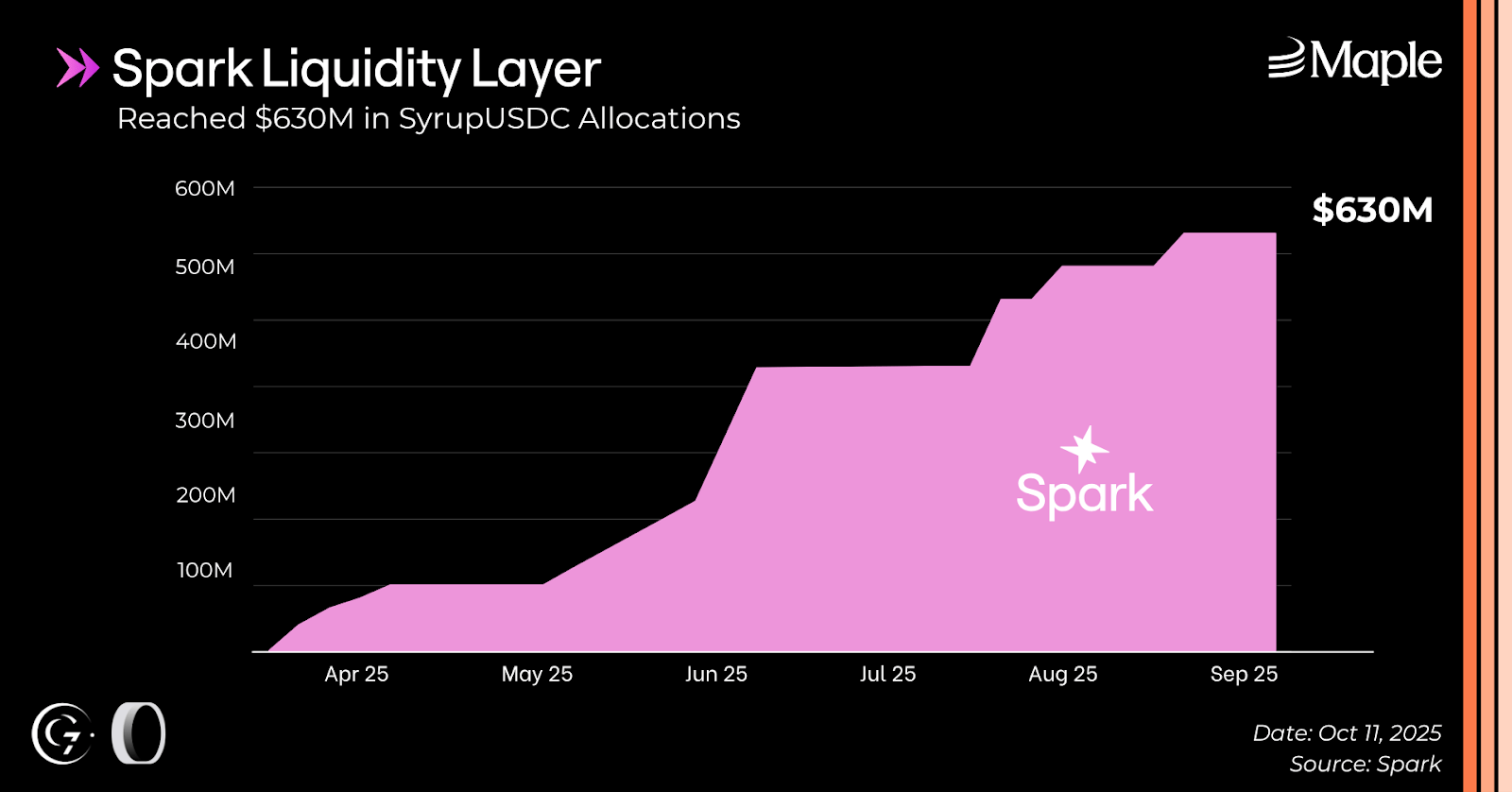

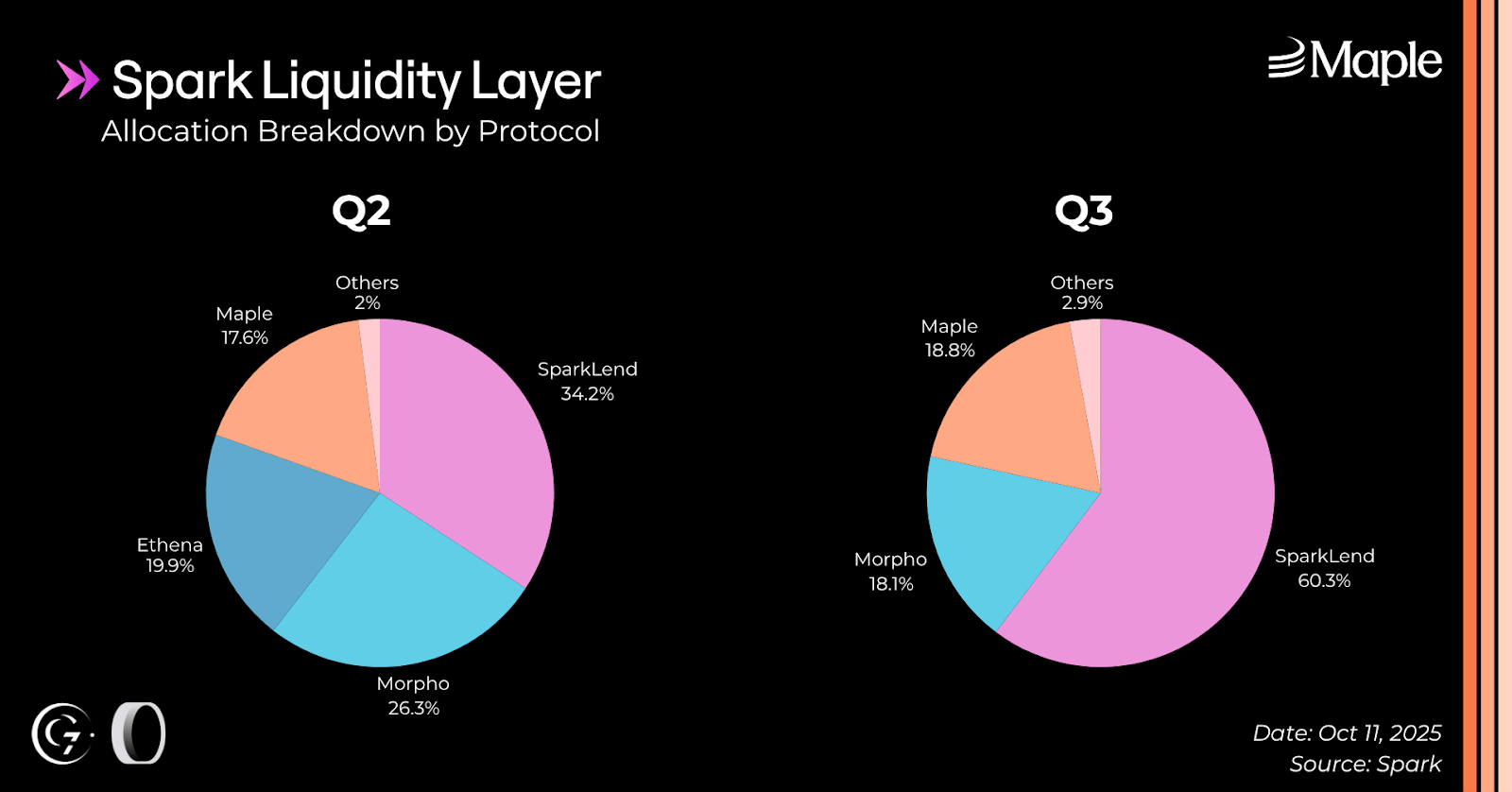

On Ethereum, syrupUSDC remains a cornerstone asset within the DeFi lending landscape. While its presence across protocols such as Morpho, Pendle, and Euler slightly declined during the quarter, Spark significantly increased its allocation.

syrupUSDC now represents 18.79% of the Spark Liquidity Layer, making it the second-largest position. Spark also fully withdrew its exposure to sUSDe (Ethena) and reallocated capital to syrupUSDC, a move that underscores growing institutional confidence in Maple’s yield-bearing dollar.

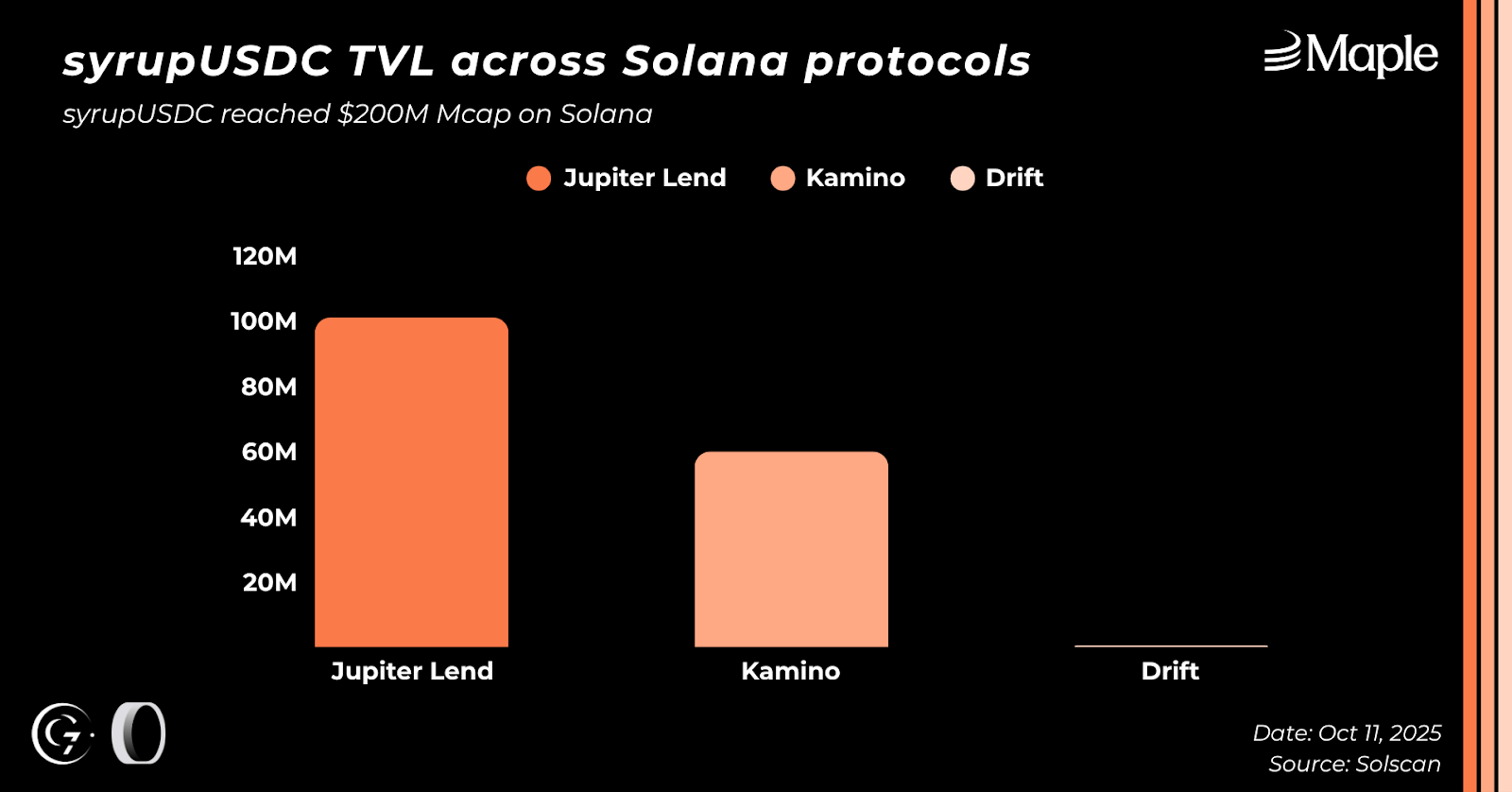

On Solana, syrupUSDC’s deployment expanded rapidly following its June launch, rising from 50 million dollars to over 200 million dollars in Q3. This growth was primarily driven by Jupiter Lend, which attracted more than 100 million dollars in deposits.

syrupUSDC has now become the largest yield-bearing dollar asset on Solana, supported by attractive DeFi opportunities offering APYs of up to 30% on platforms such as Jupiter Lend and Kamino.

On Arbitrum, syrupUSDC reached $85 million in supply, representing 6.83% of total cross-chain supply. Its rapid adoption was boosted by The DRIP (DeFi Renaissance Incentive Program), a four-season initiative distributing 80 million ARB tokens to stimulate liquidity and yield activity across the ecosystem.

syrupUSDT

While syrupUSDC continued to perform strongly, syrupUSDT was the standout performer of the quarter. Its resurgence was powered by the launch of Plasma, a Tether-backed protocol that enabled Maple to relaunch its USDT-based yield product. syrupUSDT’s AUM grew by 342.3%, from 143.82 million dollars to 636.15 million dollars, making it Maple’s fastest-growing product in Q3. Approximately $348 million, or 46% of syrupUSDT’s total supply, is now deployed on Plasma.

Final Thoughts

Q3 confirmed Maple’s position as one of the most credible and efficient yield platforms in DeFi. syrupUSDC(T) continued to demonstrate its strength through steady growth, consistent yield delivery, and expanding cross-chain integrations. Its combination of institutional credit exposure, transparent yield generation, and robust risk management has set a new benchmark for what a sustainable yield-bearing dollar can achieve in decentralized finance.

The data this quarter tells a clear story. syrupUSDC(T) maintained strong and stable returns while attracting substantial new inflows, supported by increasing integrations across major protocols. The product’s ability to combine liquidity, transparency, and stability distinguishes it from many competitors that rely heavily on temporary incentives or untested yield models.

There is a growing market consensus: investors are beginning to perceive syrupUSDC(T) not as a high-risk, high-reward asset, but as a reliable, institution-grade yield instrument. This shift in perception reflects Maple’s progress in building trust, creditworthiness, and consistent performance.

Looking ahead, Maple is well positioned to continue scaling its on-chain credit markets, expand syrupUSDC(T)’s multi-chain presence, and strengthen its role as a core yield layer within DeFi. With strong fundamentals, disciplined risk management, and increasing market adoption, syrupUSDC(T) stands out as one of the few DeFi-native assets capable of bridging institutional capital and decentralized yield in a sustainable way.

Hope you enjoyed reading this report.

If you found it valuable, feel free to share it with others and follow us on X. You can also join our free Telegram group, we’re always up for thoughtful discussions and idea-sharing with the community.

Stay tuned, more in-depth insights are coming your way soon.