- GLC Research's Newsletter

- Posts

- Introducing Euler Finance: "On its way to become a DeFi Super App?"

Introducing Euler Finance: "On its way to become a DeFi Super App?"

Euler has been one of the breakout stories of 2025. During the first half of the year, the protocol’s TVL surged from $189M in January to more than $2.9B, while total borrows climbed to $1.5B.

Welcome to the GLC Research Newsletter.

We’re a buyside crypto research firm focused on delivering clear, independent insights. We also collaborate with a few select projects to help improve transparency and reporting for stakeholders.

In this edition, we’re covering Euler Finance, a comprehensive breakdown of one of the most compelling growth stories in DeFi right now. If you're looking to understand where Euler stands today and where it’s headed next, this report has everything you need.

Thanks again for subscribing. We’re glad to have you with us.

Let’s get into it.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Disclosure: The analysts behind this research are part of the Euler Ambassador Program but are committed to remaining fully independent in their assessment.

Key Takeways

Comprehensive Platform: Euler positions itself as a DeFi “super app,” combining lending, borrowing, swapping, liquidity provision, and soon fixed yield.

Strong Growth: TVL grew from $189M to $2.9B in 2025, with $1.5B in active loans and a 51% utilization rate, one of the highest in DeFi.

Capital Efficiency: The fully customizable vault-based architecture seems to appeal, with over 20,000 monthly active users.

Financial Momentum: Over $2M in cumulative revenue since V2 launch, with monthly revenue on track for $500K ($6M annualized).

Risk Management: Despite added complexity, Euler reinforces security with 40+ audits, bug bounty programs, and continuous monitoring.

Introduction

Euler has been one of the breakout stories of 2025. During the first half of the year, the protocol’s TVL surged from $189M in January to more than $2.9B, while total borrows climbed to $1.5B, giving it one of the highest utilization rates in DeFi at 51.4%. This momentum also fueled a sharp rally in the governance token EUL, which is up 245% year-to-date.

Yet despite these headline numbers, many still ask: what exactly is Euler?

Euler presents itself as a DeFi “super app,” and the label is deserved. The platform brings together all of DeFi’s core activities in one place: lending and borrowing, asset swaps, liquidity provision, and soon fixed yield products, with additional features already on the roadmap.

The project initially launched with a focus on lending and borrowing markets before expanding with EulerSwap, an exchange layer built directly on top of its core architecture.

But what exactly is Euler’s Core Architecture?

Euler Architecture: Vaults

At the core of Euler’s design lies the concept of vaults. A vault can be thought of as a container where assets are deposited. Within this container, assets can serve three key purposes: they can be lent out, borrowed, or used as collateral. What distinguishes Euler is that, in many cases, a single vault can perform all three functions at once.

This is not the norm across lending and borrowing protocols, many of which rely on more restrictive market structures.

Below are some of the classical designs that have emerged in DeFi.

Simple Collateral–Debt Pairs

The most basic design connects two vaults: one lending assets and another escrowing collateral to borrow. For example, a USDC vault may lend while an ETH vault secures those loans. This model isolates risk but fragments liquidity and limits efficiency. Protocols like Morpho, FraxLend, and Kashi follow this structure.Multi-Collateral Markets

A more advanced model allows a lending vault to accept multiple collateral types, such as ETH, DAI, and UNI. This consolidates liquidity, reduces rate volatility, and improves efficiency compared to isolated pairs. Compound V3 is the best-known example.Rehypothecated Collateral Pairs

The most sophisticated model enables bidirectional collateralization: assets in Vault A can secure borrowing from Vault B, and vice versa. Known as rehypothecation, it boosts capital efficiency by keeping collateral productive, lowering borrowing costs, and unlocking indirect borrowing paths. Protocols like Silo & Fluid use this architecture to support complex strategies.

Unlike traditional protocols that follow fixed templates, Euler enables builders to design markets with complete flexibility. Developers can link vaults in any configuration, reuse existing ones to bootstrap new markets, and adapt structures over time to match different risk and return profiles.

Euler is the only lending protocol with flexibility to replicate all of the designs of all the other protocols mentioned above. This openness fosters composability and innovation, allowing markets to extend beyond classical designs.

Key Metrics since Inception

With the introduction of its fully customizable markets model, launched in September 2024 alongside the deployment of Euler V2, the protocol appears to have achieved strong product-market fit. Total Value Locked (TVL) has surged from virtually zero to $2.9B in less than a year, supported by a growing base of over 20,000 monthly active users.

More importantly, Euler has demonstrated not only its ability to attract deposits but also to ensure those assets are actively utilized.

The protocol now supports $1.5B in active loans, giving it one of the highest asset utilization rates in DeFi, with an active loans-to-TVL ratio of 51.4%.

This level of utilization is driven both by Euler’s flexible, fully customizable architecture and by the recently launched EulerSwap, which we will examine in the following section.

The DAO has also benefited directly from this growth. Since the launch of Euler V2, the protocol has generated over $2M in cumulative revenue, with revenue growth closely tracking TVL expansion. At the current pace, Euler is on track to reach $500K in revenue this month alone, which translates into an annualized run rate of approximately $6M.

August revenue: ~$425K (as of publication).

EulerSwap: Redefining Capital Efficiency in DeFi

Euler recently launched EulerSwap, a DEX built directly on top of its lending and borrowing primitives. The motivation behind this design was to solve two major inefficiencies that plague traditional DEXs:

Poor capital utilization: liquidity in AMMs is notoriously underutilized.

Illiquidity of LP positions: in most DEXs, liquidity provider (LP) tokens cannot be used as collateral in lending protocols, which limits composability and capital efficiency.

By building a DEX natively on top of a lending/borrowing protocol, Euler introduces a breakthrough: all idle assets in vaults can be simultaneously deployed to facilitate swaps. This dramatically increases the utilization rate of assets across the system.

For liquidity providers, this unlocks powerful new strategies. Suppose you deposit ETH and USDC as liquidity for EulerSwap. If those assets are also accepted as collateral in other vaults, your LP position becomes borrowable collateral. This means you can borrow against your LP position to pursue other opportunities, such as hedging or quickly seizing yield opportunities on external protocols, all while maintaining your LP exposure.

This design gives Euler the highest utilization rate of any DeFi protocol.

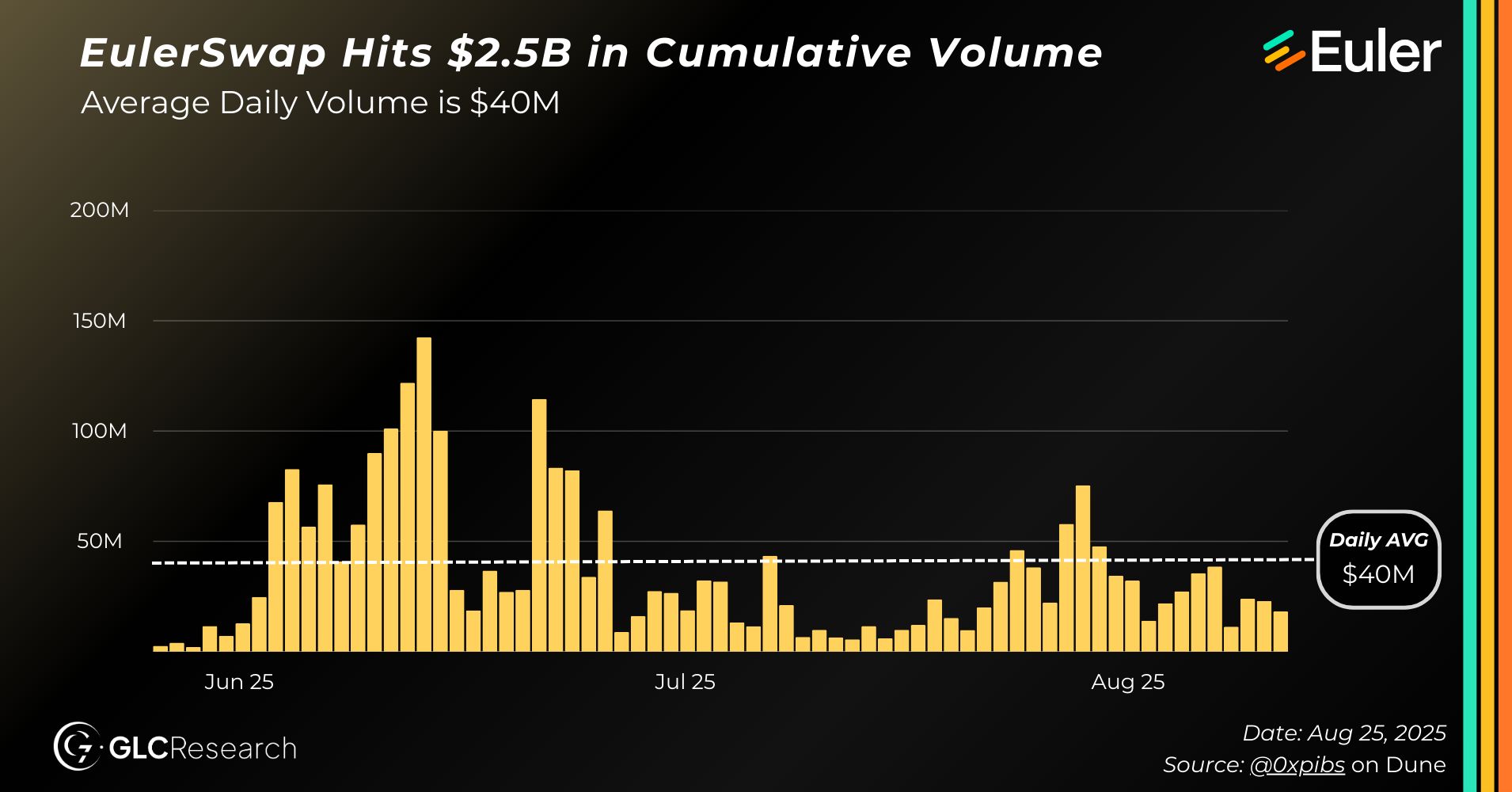

Another key advantage of EulerSwap is its ability to generate significant trading volume from relatively small amounts of liquidity. With just $5M in TVL, EulerSwap has processed $2.5B in trading volume within a few months, averaging $40M in daily volume. Since launch, the protocol has generated around $50,000 in fees.

It’s a strong start, even if the numbers still remain modest compared to competing DEXs. That said, Euler has never been known primarily as a DEX. EulerSwap only launched its beta version in June, and it will take time to educate the community and establish its place on the map.

To illustrate the difference:

On Uniswap, if you deposit $1M, the maximum single trade size you can satisfy is roughly $1M.

On EulerSwap, under optimal conditions, that same $1M in deposits can support trades of up to $50M, 50 times more.

This structural advantage highlights why Euler is positioning itself as not just another lending protocol or DEX, but as a capital efficiency powerhouse within DeFi.

Risks & Considerations

Naturally, Euler’s fully customizable market model and the launch of EulerSwap on top of the protocol introduce more complexity, and therefore more risk, compared to simpler designs.

That said, Euler takes security seriously. The protocol has undergone more than 40 audits conducted by leading Web3 security firms, runs an active bug bounty program, and benefits from continuous monitoring by specialized security companies, among many other safeguards.

Of course, zero risk does not exist in DeFi, but Euler appears well-prepared to handle potential challenges ahead.

Final Thoughts

Euler’s trajectory in 2025 highlights just how quickly innovation in DeFi can reshape the landscape. In less than a year, the protocol has evolved from a promising relaunch with V2 into a multi-billion dollar platform with one of the highest utilization rates in the industry, strong revenue momentum, and a growing base of users. Its fully customizable market architecture and the launch of EulerSwap mark a clear departure from traditional models, positioning the protocol as a true capital efficiency engine rather than just another lending platform or DEX.

Challenges remain, particularly around the added complexity and risks that come with such a flexible design, but Euler has demonstrated a proactive approach to security and resilience. If current growth trends continue, Euler could cement itself not only as one of DeFi’s breakout stories of 2025, but also as a long-term pillar of on-chain financial infrastructure.

This article serves as a first introduction to Euler. Over the coming weeks, we will continue publishing deeper research on the project and will also release a full investment thesis in collaboration with our partners at OAK Research.

For those interested in exploring further right away, OAK has already published several insightful articles on Euler, which we highly recommend checking out.

Hope you enjoyed reading this quarterly report.

If you found it valuable, feel free to share it with others and follow us on X. You can also join our free Telegram group, we’re always up for thoughtful discussions and idea-sharing with the community.

Stay tuned, more in-depth insights are coming your way soon.