- GLC Research's Newsletter

- Posts

- Hyperliquid’s Scalability

Hyperliquid’s Scalability

How 14 People Are Outpacing Robinhood?

Welcome to the GLC Research Newsletter.

We’re a buyside crypto research firm focused on delivering clear, independent insights. We also collaborate with a few select projects to help improve transparency and reporting for stakeholders.

In this edition, we’re covering Hyperliquid’s scalability. From Unit enabling spot and deposits, to builder codes driving billions in volume, to HIP-3 equity perps and USDH opening new revenue streams, this article explains how Hyperliquid scales globally with a 14-person team while outgrowing giants like Robinhood.

Thanks again for subscribing. We’re glad to have you with us.

Let’s get into it.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: Analyst (Yarl from GLC) behind this research owns $HYPE. Full disclaimer and disclosure here.

Introduction

Hyperliquid is a + $1B free cash flow company, growing triple digits year-to-date, competing with Robinhood in terms of volume and earnings, using 99% of that FCF for buybacks, while being only one year old with a team of 14 people.

Sounds crazy, right? That’s the beauty of blockchain and decentralization.

I won’t dive into all the factors that made Hyperliquid a successful perpetuals DEX in the first place. The main reason is simple: they built the best venue for trading crypto perpetuals. They achieved strong product–market fit by developing the most suitable blockchain for trading and by being one of the most ethical teams ever seen in crypto, airdropping billions to their genesis users and creating a strong sense of belonging within the Hyperliquid community. They were the first to do something of this scale. It was unprecedented, and it will never be replicated to the extent Hyperliquid did.

But the goal was never to build “just another perp DEX”.

The goal has always been to house all of finance and become the liquidity layer that third parties can plug into: The AWS of liquidity.

Let’s dive into Hyperliquid’s scalability and how they are achieving triple-digit growth with little to no marginal cost.

Unit: Hyperliquid’s X Factor

The first step toward housing all of finance was enabling seamless deposits and withdrawals, making BTC, ETH, and SOL feel native with no single point of failure, while also supporting spot trading. Unit was the third-party team that implemented this, remaining fully aligned with Hyperliquid and focused on building the right infrastructure for Hyperliquid to scale. Not everything Unit does is visible, but a significant part of the system relies on their work. If you want to learn more about Unit and guardians, check this article from Blocmates.

That said, some results are very tangible:

Unit total volume surpassed $50B

98% of spot revenue was used to buyback $HYPE

Unit’s TVL is around $500M, peaking at $1,3B before 10/10

More than $500M has been deposited through Unit

Hyperliquid has become one of the best spot trading venues for new launches and majors

Whales now use HL Spot to trade billions

…

Long story short, Unit is an external team building on Hyperliquid that enabled Hyperliquid to scale, made spot trading competitive vs. CEXs while deposits and withdrawals feel native, and directed 98% of spot revenue to buying back $HYPE, remaining fully aligned with Hyperliquid. This cost Hyperliquid zero marginal cost, and it enabled growth that cannot even be measured.

If Hyperliquid is what it is today, it is partly because of Unit.

We’ve seen people arguing whether Hyperliquid’s core team should have built spot trading themselves. The reality is simple: be grateful Unit exists. They exceeded anything anyone could have imagined and continued building, directly benefiting both Hyperliquid and $HYPE.

This is the first reason why Hyperliquid remains a 14-person team while using 99% of its revenue to buyback $HYPE.

Builder Codes: Driving Billions in Volume

Builder codes are the second reason why Hyperliquid has such large profit margins. Builder codes allow anyone, through just a few lines of code, to plug into Hyperliquid’s infrastructure and liquidity and focus solely on the front-end and distribution, completely permissionlessly. Phantom was one of the biggest first movers here, integrating Hyperliquid perp trading directly into the Phantom wallet.

We won’t dive into the details here (more details here), but the most important point is that this creates a win–win relationship between Hyperliquid and front-ends. Front-ends do not need to worry about infrastructure, liquidity, or security. They can simply plug into Hyperliquid and offer new services to their users while charging additional fees on top of HL’s: Phantom has made millions through this integration.

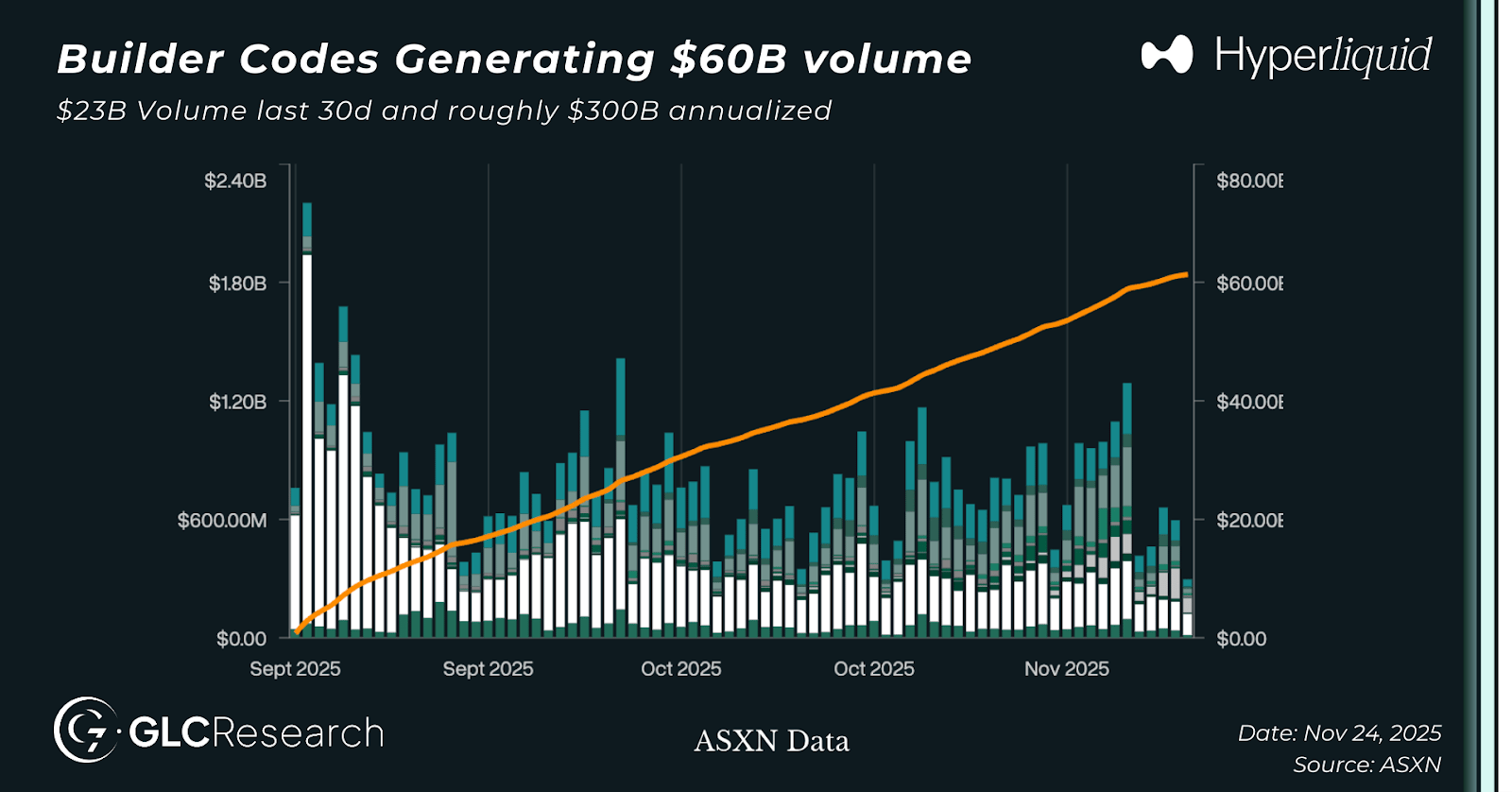

It has been less than three months since builder codes went live. Dozens of front-ends have already integrated with Hyperliquid, generating more than $60B in volume, including $23B over the last 30 days. That is roughly $300B annualized, and it will likely continue to grow.

Using Hyperliquid’s average fee per dollar of volume, this already represents around $100M in revenue/buybacks per year. That is roughly 10% growth enabled by builder codes, while costing Hyperliquid zero. They did not need to hire anyone or spend a single dollar for Phantom to integrate. It is a perfect snowball effect: people plug into Hyperliquid because liquidity is the moat, and as more front-ends integrate, liquidity deepens even further, pushing more and more front-ends to follow. Teams like EtherFi have also announced their integration with Hyperliquid, and more are likely coming.

It is pure game theory.

This is the second reason why Hyperliquid remains a 14-person team while using 99% of its revenue to buy back $HYPE.

The Distribution: Hyperliquid is borderless

The third reason is the fact that Hyperliquid is a decentralized blockchain. This means anyone can access it permissionlessly, anytime and anywhere (hopefully soon in the US).

The key point here is that Hyperliquid can distribute its product globally without spending a single dollar to gain market share in specific countries. By design, it is decentralized, which gives it a strong advantage when you consider what companies like Robinhood have to spend to offer services in Europe, for example. Of course, some regulatory concerns come with this approach, but clarity will eventually come.

Long story short: Hyperliquid is borderless, with no additional marginal cost and this is the third reason why Hyperliquid remains a 14-person team.

Equity Perps: HIP-3

HIP-3 (Hyperliquid Improvement Proposal 3) was recently activated and makes the listing of new perpetual futures markets fully permissionless.

In practice, HIP-3 allows anyone staking 500k HYPE tokens to create a new perpetual futures market on Hyperliquid. This is a key step toward decentralizing market creation: it turns the Hyperliquid blockchain into a financial infrastructure layer where third parties can deploy markets without asking for permission.

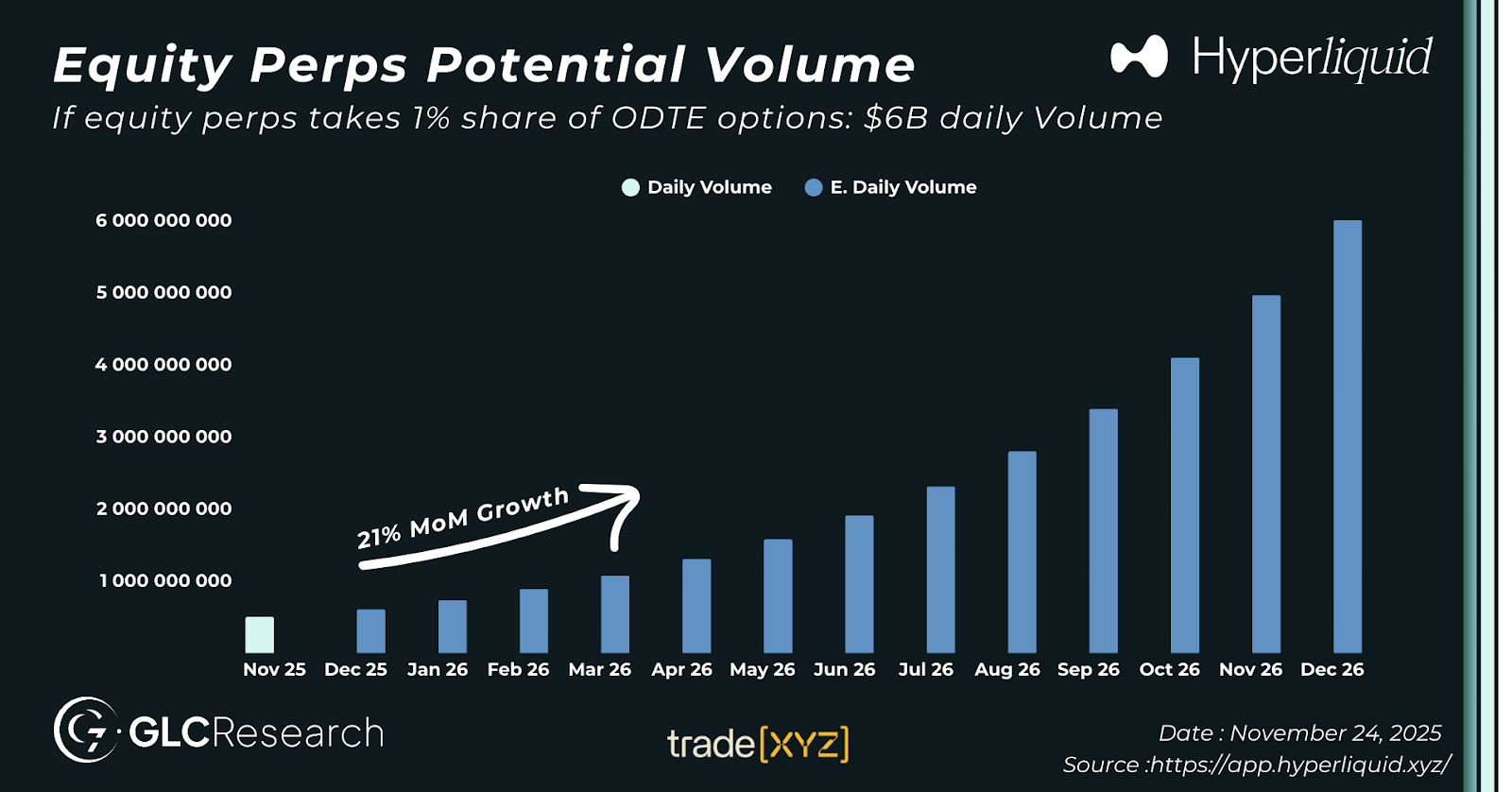

The first HIP-3 markets have already significantly expanded Hyperliquid’s TAM. Unit (Trade.xyz) was the first HIP-3 deployer and has already listed dozens of equity perps, including the Mag7. After just a few weeks, these markets are already doing around $500M in daily volume.

The TAM increased dramatically because equity perps are very similar to short-dated options, or 0DTE options. In August, Mag7 0DTE options had more than $630B in daily volume per Bloomberg. If Hyperliquid captures just 1% market share, that would represent more than $6B in daily volume, or over $2 trillion in annual volume based solely on 0DTE options.

This is not a prediction, we will share a valuation framework soon, but it shows the scale of the opportunity.

That would represent more than a 60% increase in Hyperliquid’s volume, revenue, and buybacks, considering only Mag7 equity perps deployed by Unit/Trade.xyz, while again requiring almost zero marginal cost from the Hyperliquid team.

We also have Felix Protocol, which is deploying equity perps using Hyperliquid’s native stablecoin, USDH, as the quote asset, and Ethena, which will launch its own HIP-3 market using USDe as collateral (HyENA). We don’t have a crystal ball, but the opportunity is clearly here, and reaching $500M in daily volume after only a few weeks is a very positive sign.

This is the fourth reason why Hyperliquid remains a 14-person team.

Hyperliquid’s Stablecoin: USDH

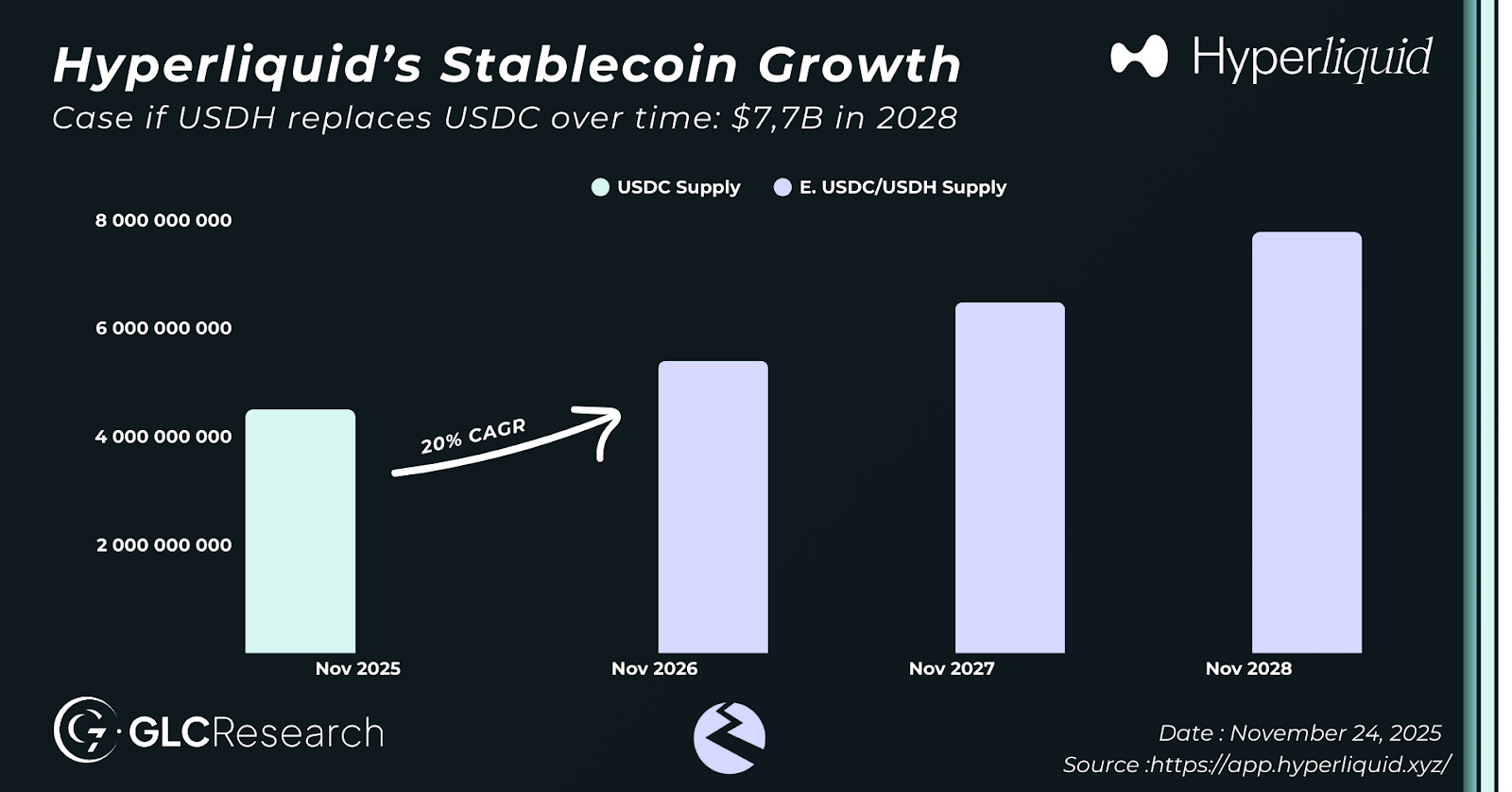

Hyperliquid’s stablecoin was a missing piece for the ecosystem to truly thrive over the long term. Until now, USDC has been the largest stablecoin on Hyperliquid, with around $4.5B in supply sitting on the platform, which only benefits Circle and provides no value back to $HYPE or the community. If this supply were instead in USDH, it would represent roughly $100M in additional revenue, with 50% flowing back into $HYPE buybacks, as Native Markets has committed to allocating 50% of revenue to buybacks and 50% to growth.

Stablecoin supply is expected to grow at 20% CAGR over the coming year (per Citi), and we could argue that it may grow even faster on Hyperliquid if the ecosystem continues expanding at the current pace. Starting from today’s $4.5B supply and compounding at 20% over the next three years, this could reach around $7.7B sitting on Hyperliquid, generating (using a 3.5% risk-free rate) approximately $270M in annualized revenue for Hyperliquid.

This is not a prediction, but it shows the potential TAM for USDH.

This comes with a very low marginal cost for Hyperliquid. Fees are reduced for markets using USDH as the quote asset, but USDH introduces a new monetization line that is less correlated to market conditions and performs well when interest rates are high. Once again, it is a highly scalable revenue stream for Hyperliquid with no direct operating costs.

This is the fifth reason why Hyperliquid remains a 14-person team.

Closing Thoughts: Hyperliquid’s Community

Hyperliquid’s scalability comes from a simple but powerful combination: a decentralized L1 and exchange architecture, permissionless market creation, and a community that is fully aligned with the protocol from day one. Hyperliquid changed the rules by rewarding its core users in a way the industry had never seen before, directing every dollar of revenue back to holders and builders. It was unprecedented in crypto, and it created a level of organic alignment that cannot be replicated through incentives.

Today, every project is trying to apply the same playbook. But you can copy the mechanics, not the culture. The first mover always has the most organic path ahead.

Hyperliquid is no longer “a team of 14 people”. That number may be the official headcount, but in reality, hundreds of people are building around Hyperliquid, contributing infrastructure, distribution, research, products, and liquidity, all pushing toward the same vision: housing all of finance. The community is the final reason why Hyperliquid’s scalability is unmatched.

The foundation is here. The incentives are aligned. The flywheel is spinning and it is scaling with little to no marginal cost.

Hyperliquid.

Hope you enjoyed reading this article.

If you found it valuable, feel free to share it with others and follow us on X. You can also join our free Telegram group, we’re always up for thoughtful discussions and idea-sharing with the community.

Stay tuned, more in-depth insights are coming your way soon.