- GLC Research's Newsletter

- Posts

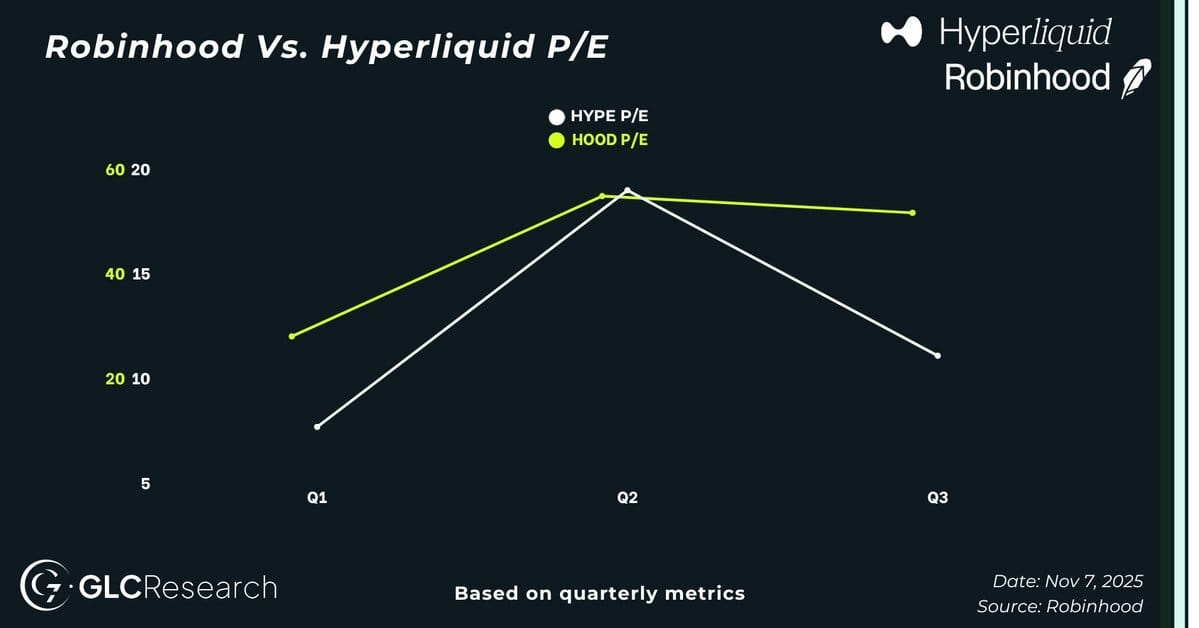

- $HOOD vs $HYPE: Q3 Earnings and Valuation Comparison

$HOOD vs $HYPE: Q3 Earnings and Valuation Comparison

Welcome to the GLC Research Newsletter.

We’re a buyside crypto research firm focused on delivering clear, independent insights. We also collaborate with a few select projects to help improve transparency and reporting for stakeholders.

In this edition, we’re comparing Hyperliquid’s quarterly and year-to-date results with Robinhood’s. It’s a very short comparison, but it still raises important questions about whether the market is fairly valuing $HYPE.

Thanks again for subscribing. We’re glad to have you with us.

Let’s get into it.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: We own $HYPE and are clearly biased.

$HOOD VS. $HYPE

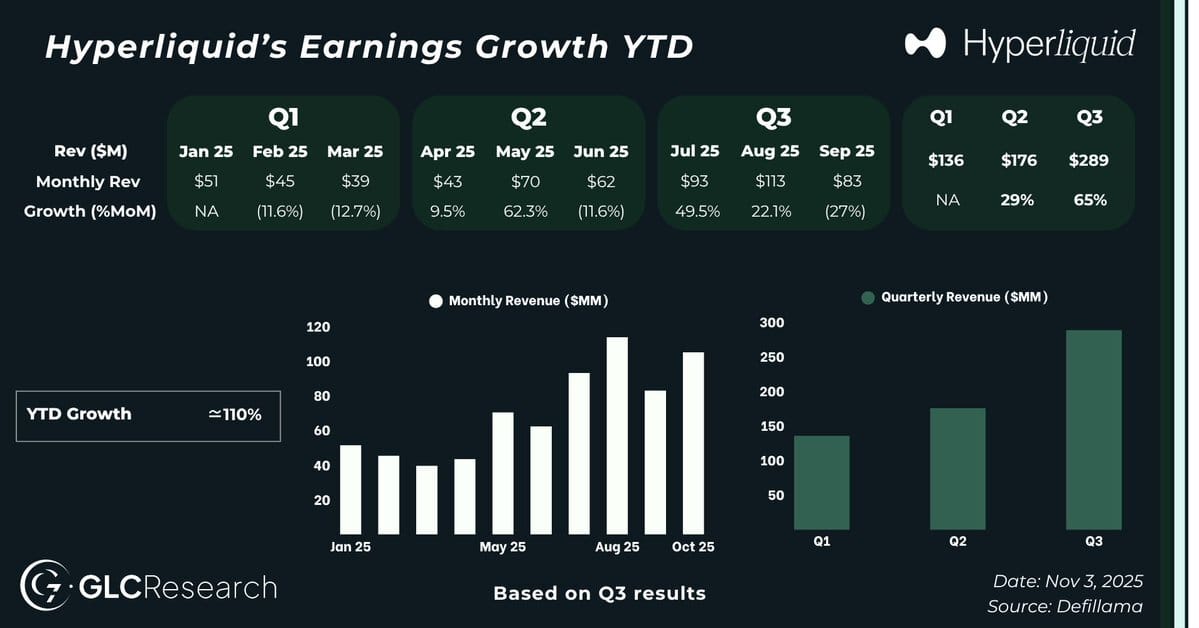

Hyperliquid Q3 revenue/earnings:

$289M with 99% used for buybacks

65% QoQ growth

$1.15B in annualized earnings

110% growth YTD (quarterly results)

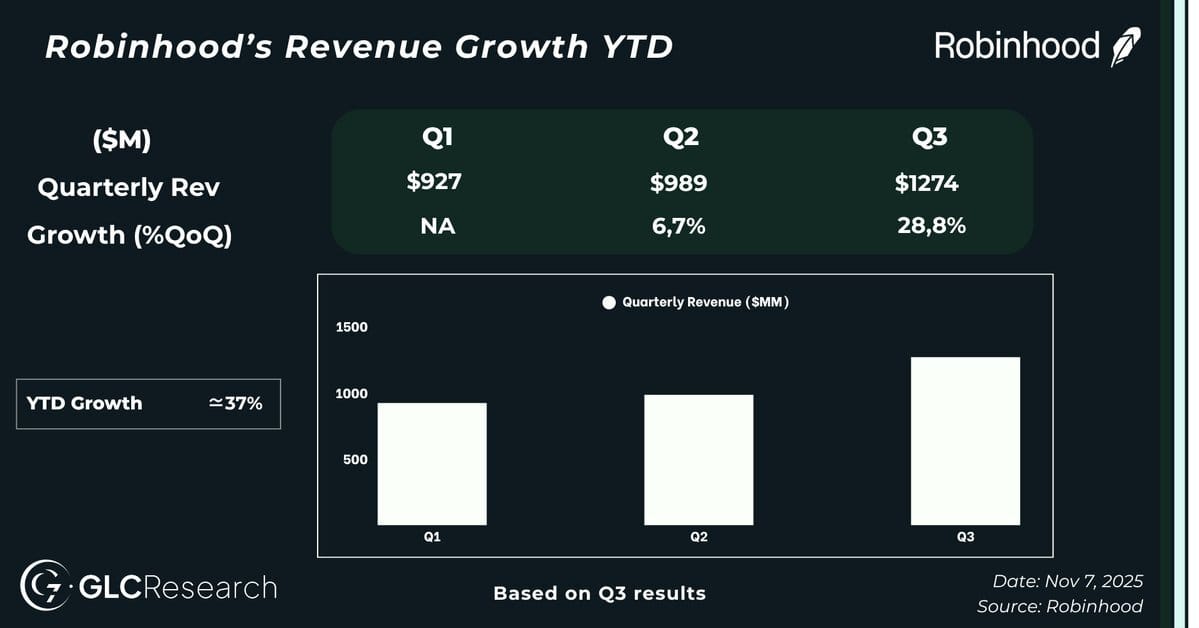

Robinhood Q3 Revenue:

$1.27B in revenue

28.8% QoQ growth

$5B in annualized revenue

37% growth YTD

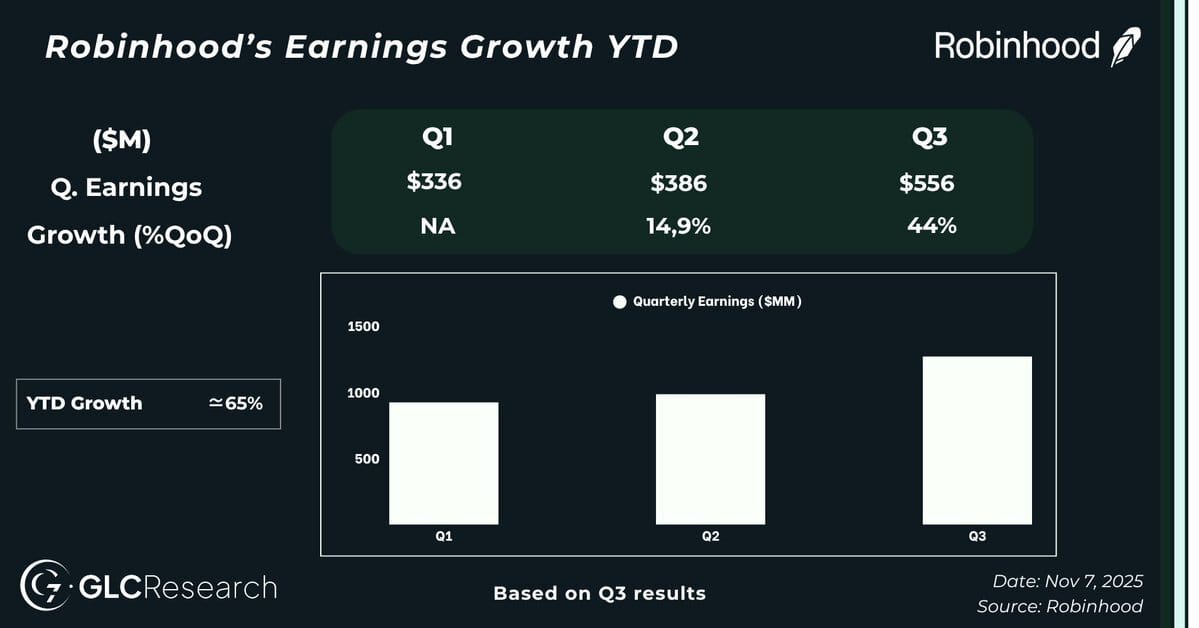

Robinhood Q3 Earnings:

$556M in earnings

44% QoQ growth

$2.2B in annualized earnings

65% growth YTD

Both companies have executed well and delivered strong growth. However, Hyperliquid has been expanding at a faster pace YTD.

For Hyperliquid, revenue equals earnings, and earnings equal "dividends" since 99% of those funds are used for daily $HYPE buybacks.

Spoiler: faster growth doesn’t guarantee future outperformance. Valuations are based on future expectations.

Still, let’s look at the facts:

Hyperliquid has been live for about a year.

It already competes with Robinhood in terms of earnings.

It has grown faster YTD (110% vs 65%).

Every dollar earned is distributed to holders through buybacks.

Hyperliquid is also an L1, which isn’t yet priced in.

Despite this, $HYPE trades at a P/E of around 11, while $HOOD trades above 50.

That either means the market expects Hyperliquid’s growth to slow significantly and lose market share, or it means the market is missing something.

There are valid reasons why $HYPE trades at lower multiples (covered on our website), but $HOOD trading at a 5x higher P/E ratio while growing slower and showing lower profit margins seems exaggerated.

All eyes now on Hyperliquid Strategies, likely launching by the end of the month.

Hyperliquid.

Hope you enjoyed reading this small analysis.

If you found it valuable, feel free to share it with others and follow us on X. You can also join our free Telegram group, we’re always up for thoughtful discussions and idea-sharing with the community.

Stay tuned, more in-depth insights are coming your way soon.